News

Bartlesville

Posted: May 27, 2020 9:34 AMUpdated: May 27, 2020 10:35 AM

Former Creamery Purchased for Future Development

The Bartlesville Development Authority approved a proposal to purchase the former Crystal Creamery building at 515 W. Frank Phillips Boulevard for $165,000.

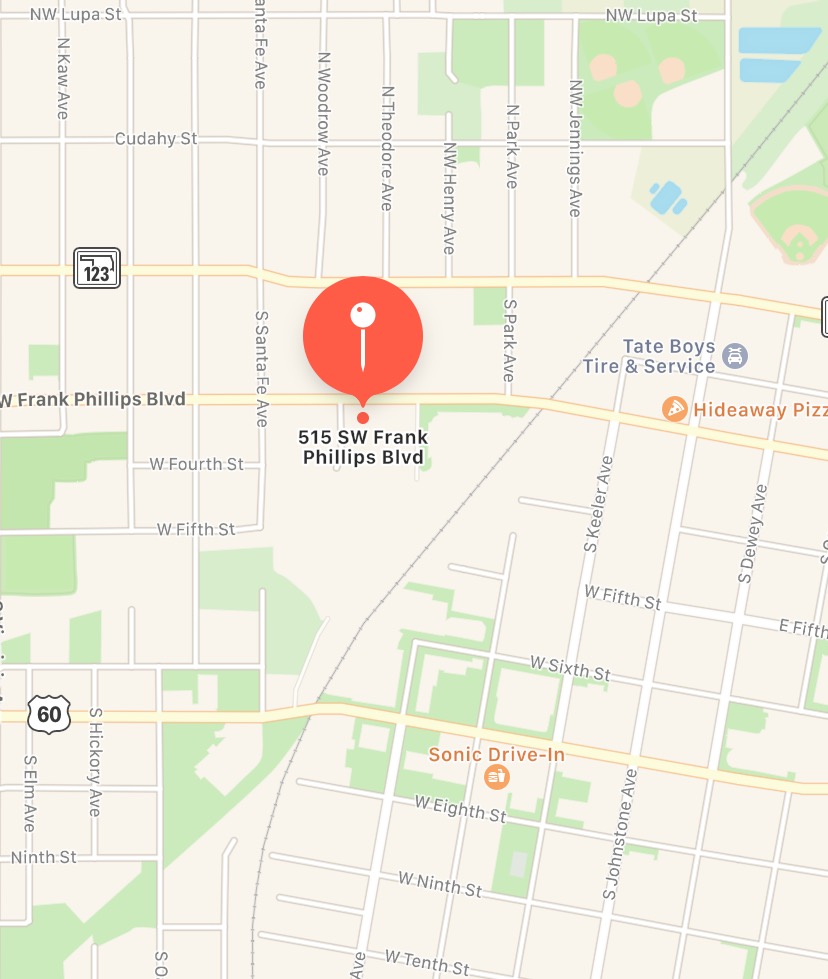

The BDA also approved for renovations not to exceed $2-million for leaseback to Mark Spencer for locating a boutique butchery, dairy, and bakery operation into the building. BDA President David Wood said he spoke two weeks ago with Spencer, the proprietor of the Painted Horse, about the opportunity to open up the business in partnership with Amelia Creamery out of Nowata to produce ice cream. He said Spencer would also be available for retail purchase of Angus beef at the counter along with the ice cream. The location of the former creamery is pictured below.

Mark Spencer employs 135 people in the Bartlesville area. Wood said that Spencer feels confident in the action and is willing to personally guarantee the lease. He said he has nothing but respect for Spencer for stepping out on this venture.

Upon extensive renovation the facility will function as a boutique butchery for Angus beef raised on Wolf Creek Ranch, Spencer’s Washington County cattle ranch, and finished at local micro feed lot, Trinity Cattle Company, of which Spencer is also partner. This premium beef will continue to supply his downtown Painted Horse restaurant, with the addition of a retail fresh meat counter within the production facility.

A creamery division will consist of Spencer in partnership with Amelia’s, a local Nowata-area yogurt manufacturer and creamery, in selling high-end French style yogurt for the local, national and international markets. They will also be producing and offering ice cream and other dairy products. Under Spencer’s umbrella, this division will also be developing, producing and offering provisions such as sauces, jams, rubs and seasonings which will be available for retail purchase.

Upon successful establishment of the meat and dairy operations, Spencer’s plans include the installation of a bakery, with the potential of combining the three stand-alone operations for a deli counter, thus providing three channels for locally-produced product distribution: Farm-to-plate through the Painted Horse, retail purchase of locally-sourced meat, dairy, and baked-goods, and ultimately, on-site consumption in a new, west side deli.

Financially, the opportunity works out for the Bartlesville Development Authority. Wood said the BDA could borrow fixed rate terms very cheaply for 15-years. He said they would be matching the tenants lease rate to the BDA's debt service. Whatever the BDA pays for the debt service is what the tenant would pay for rent. The duration of the lease would match the duration of the loan.

Wood said this seems to be a chance to address diversification in business. He said it is also a great opportunity to renovate an iconic building and bring it back to life. Bringing the building back to life will offer more opportunities for tourism, and it will help local businesses that want to expand during the COVID-19 pandemic.

A recommendation to the Bartlesville City Council to allocate $220,000 from the Economic Development Fund for a forgivable loan to Spencer for the creation of 22 new food processing jobs was also approved by the Bartlesville Development Authority.

Trustee Chris Batchelder gave kudos to Wood and Spencer for seeking this opportunity. He said it is a great statement on the BDA's reinvestment in the west side of Bartlesville, and that it fits squarely with what the BDA hopes to achieve for the community.

The proposed location is badly-deteriorated. Spencer’s architect, Ambler Architects, is familiar with the facility having evaluated a renovation for a previous, similar use which ultimately did not move forward. Ambler estimates it will take approximately $2 million for restoration. From a pure financial/business operation standpoint, it would likely be more cost efficient to build new, or locate elsewhere in an existing facility in better condition. Outside of significant BDA involvement it is likely not feasible to pursue this location. Nevertheless, there is perceived value to the community, and Spencer’s brand, for restoring this iconic, high-visibility structure on the west side.

From BDA’s standpoint, the recent sale of the ABB facility has provided substantial cash earmarked for investment in new, brick-and-mortar opportunities. As Spencer’s plan is primarily a food processing operation (manufacturing), it would traditionally rank as a high-value opportunity for BDA – particularly as it is outside of the energy sector, thus supporting diversification.

Staff proposes that BDA consider purchase/renovation of the facility, with a long-term leaseback to Spencer. As with our previous build-to-suit expansion with ABB, BDA can comfortably provide the 20 to 25-percent equity ($433,000 – $541,000) and finance the remaining $1.7 to $1.6 million taking advantage of the historically-low interest rates with long-term, fixed-rate financing. As with ABB and the Springs Warehouse, the lease would be structured as “rent = BDA debt service” and the length of lease term would match the term of BDA’s loan.

While there is always risk of failure with any new enterprise, Spencer is a well-known, successful member of the Bartlesville business community, and this market expansion is within his demonstrated area of expertise.

As a maximum downside consideration, BDA could, in the event of failure, be the owner of a vacant fully-reconditioned 13,500-squarefoot facility on Bartlesville’s main thoroughfare, with total investment risk of approximately $2.17 million. For comparison and precedent, BDA could, in the event of default, also own a newer 50,000 sqft warehouse in Bartlesville Industrial Park having investment risk of approximately $1.6 million. Currently, new comparable industrial construction cost is well above the proposed all-in $160 sqft investment. Per Ambler, “Projects we were building for $200 sqft are $350 to $400 sqft today. Anywhere else this project is built would be significantly more money for the empty shell.”

Under the proposed structure, BDA would fund the equity portion out of ABB sale proceeds (BDA’s investment account), and finance the remaining $2 million with BDA as the borrower. Staff proposes to bid the financing through our local banks and anticipates obtaining a 15 year fixed-rate financing below 4-percent allowing for rent low enough to facilitate the transaction, elimination of rate risk for our tenant (and BDA) and providing BDA with an inflation hedge against a potential fall in the value of cash over the next 10 to15 years.

Customarily, BDA provides very low, or zero-interest forgivable loans of $10,000 per job for primary employees (ABB, Husky Portable Containment, Custom Molding Services, Phillips Precision Machine, etc). Traditionally, these loans are a 10 year term, with one-tenth of the loan amount payable annually, less $1,000 per job credit. This arrangement tends to assure that the funds advanced for the jobs is repaid if the job targets fail to be met – or subsequently fall below the agreed NET NEW job creation threshold.

Spencer projects hiring 20 fulltime equivalent production employees, with two production managers. Under BDA policy, this would qualify for $220,000 as a forgivable loan appropriated from Economic Development Fund (EDF) with proceeds used as equity for equipment financing. As with the lease, Spencer will personally guarantee the loan and BDA will take a subordinate security interest in the financed equipment.

Spencer’s combined operation, as presented, is expected to generate $2.3 million in taxable retail sales generating $80,000 in city sales tax. Additionally, Spencer anticipates an additional six FTE retail employees. With 80-percent of sales assigned to substitution sales, the best estimate suggests approximately $16,000 of net new city sales tax annually, or $80,000 in potential upfront incentive under policy. No credit has been applied in this proposal for new retail employment or net new sales tax.

« Back to News